Insurance Mobile App Development: Features, Benefits, Cost & Process

Manish Kumawat

Last Updated on: 02 January 2026

Today, especially in the post-pandemic era most individuals have insurance. Not only for health, but people also insure their business, vehicle, property, and life. As more people are using insurance services, insurance companies are shifting all their services through mobile applications. Here comes the role of insurance mobile app development. Before getting into insurance app development and its details, it is important to know the industry first. Let’s begin by knowing the insurance industry. Do you know?

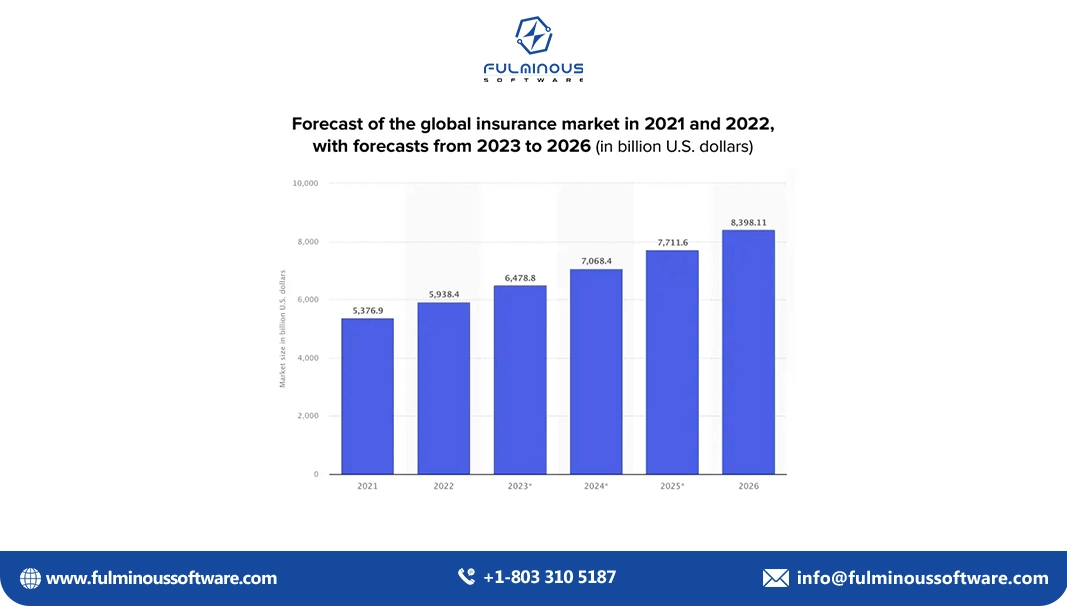

- The insurance industry is one of the largest industries in the world.

- The insurance industry’s global market value is greater than the gross domestic product (GDP) of many countries. -( source )

- The global insurance market is projected to expand by approximately one trillion U.S. dollars between 2024 and 2029, reaching nearly $10 trillion. – ( Source )

Most of the customers of insurance companies demand a feature-rich mobile application for insurance services. The convenience that an insurance mobile application offers is much greater than office services. For example, they can access and manage their insurance data from anywhere at any time.

If you have a finance and insurance organization and seeking the best insurance mobile app development company, then this guide is for you. Those who want to invest in the insurance business can also benefit from this guide. Here we are going to see all the relevant aspects of insurance application development.

Scope of Insurance Mobile App Development

If you want to know the scope of Insurance app development services and how building your own app can benefit insurance companies, you need to study two facts. The first one is the growing number of mobile users and the other growing number of insurance users. More than statistical proof, you can see the growing number of mobile phone users by watching around. On the other hand, Statista says there will be more than 800 million open insurance users by 2032.

Now, let’s see what finance and insurance organizations say:

- Almost all finance and insurance organizations (99%) intend to boost mobile app downloads within the next 12 months, with a majority (55%) aiming for an increase of more than 50%. - ( Source )

- A recent study found that 68% of finance and insurance organizations consider their mobile app essential for customer retention.

- According to PR Newswire, 85% of organizations stated that investing in mobile app features directly contributes to cost reduction.

- A J.D. Power survey revealed that 74% of customers have downloaded their insurance provider’s app, with 69% using it at least once a month, demonstrating strong user engagement.

- Research by Accenture indicates that 78% of Gen Z and Millennials expect digital interactions with their insurers, including payments and claims processing, highlighting the rising demand for mobile solutions.

- Cognizant reports that only 32% of Medicaid members have downloaded their health plan’s app, and among them, just 33% of desired features are available, revealing opportunities for improvement.

From policy management to claims processing, an insurance mobile app simplifies the entire process. When users feel happy with your services through the insurance mobile application, your business will grow rapidly.

Benefits of Mobile Apps for Insurance Companies

Insurance companies, customers, and brokers have several benefits from insurance mobile apps. When comes to the benefits of insurance organizations, it’s countless. Other than overall business growth other benefits are:

- Keeps Customers Engaged – Mobile apps make it super easy for users to access policies, file claims, and get support anytime.

- Simplifies Claims Process – No more paperwork! Customers can file and track claims instantly, speeding up approvals and reducing hassles. Insurance claim processing app development focuses on automation, fraud detection, and fast settlements.

- Easy Policy Management – Users can check, update, and renew policies on the go, making insurance handling stress-free.

- Cuts Down Costs – Automating tasks like chat support and claims processing saves time and reduces company expenses.

- Boosts Sales – Personalized recommendations and in-app purchases encourage more customers to buy policies, increasing revenue.

- Provides Valuable Insights – Apps collect user data to help insurers offer better plans and make smarter business decisions.

- Ensures Security & Compliance – Strong encryption and authentication keep customer data safe and meet industry regulations.

These are not simple exaggerations, statistics and surveys also prove the above-mentioned benefits of insurance app development. see what statistics say:

- Data from Datos Insights shows that while 70% of buyers are aware of life insurance mobile apps, only 37% use them for policy inquiries, pointing to a gap between awareness and usage.

- A Futurae study found that insurance companies saw a 40% rise in mobile app adoption after switching from SMS to app-based communications, proving the effectiveness of dedicated apps.

- Forbes reports that only 11% of new insurance policies are completed via mobile apps, while 39% are still processed over the phone, indicating significant growth potential in mobile policy management.

- Research suggests that 40% of insurance-related searches are now conducted on mobile devices, reflecting the increasing trend of consumers seeking insurance information on mobile platforms.

Features to Consider While Insurance Mobile App Development

In the insurance app development process, you need to add features for 3 categories of users including admin, users, and brokers. Because each of them needs features as per their usage. Features of successful insurance mobile apps include AI chatbots, easy claims, and secure payments.

| Feature | Admin Panel | Users | Brokers |

|---|---|---|---|

| User Management | Manage user accounts and permissions | Create and manage profiles | Manage client profiles |

| Policy Management | Create, update, and track policies | View, renew, and update policies | Assist clients in selecting policies |

| Claims Processing | Monitor and approve claims | File and track claims | Help clients with claim submissions |

| Payments & Billing | Manage payment transactions | Pay premiums and track billing history | Assist clients with payments |

| Chat & Support | Oversee customer support | Get assistance through chatbots or agents | Provide support and resolve queries |

| Document Management | Store and verify policy documents | Upload and access policy documents | Share documents with clients |

| AI-Based Recommendations | Analyze data for policy suggestions | Receive personalized policy recommendations | Offer tailored suggestions to clients |

| Notifications & Alerts | Send policy updates and reminders | Receive alerts for payments, renewals, and claims | Get updates on client activities |

| Multi-Platform Accessibility | Manage the app across devices | Access the app on mobile and web | Use the app for client interaction |

| Reports & Analytics | Generate insights on user activity | View claim and policy history | Track sales and client interactions |

The best insurance mobile app development companies can help you add these features.If you do not add all these features, you need to make separate mobile apps for insurance agents, users, and admins.

Types of Insurance Mobile Apps

Insurance app development solutions vary based on the customers your insurance company serves. So when you develop an insurance mobile app you need to add features as per the type of insurance. Here are six common categories of mobile applications developed in the InsurTech domain:

Life Insurance

A life insurance app helps users manage their policies, update beneficiaries, and check policy value. Some apps also provide quick quotes and easy sign-ups. It streamlines all routine processes, such as:

- Helping customers choose the right policy

- Reviewing terms and conditions

- Filling in relevant data online

- Making all the payments online

- Receiving instant notifications

- Automatically calculating the rate of interest

- Contacting support service via a bot

Health Insurance

Health insurance app development enables users to manage their medical coverage, view policy details, and file claims digitally. These apps often include features like:

- Selecting their preferred doctors

- Booking appointments

- Accessing documents and completing formalities online

- Searching for suitable health plans

- Comparing the rates for doctors and pharmacies

- Accessing virtual healthcare services

Vehicle Insurance

Vehicle insurance allows users to manage their auto policies, request roadside assistance, and report accidents as soon as possible. These apps offer digital insurance cards, premium payment options, and tools for documenting damage and submitting claims. Features include:

- Taking pictures of the accident site and uploading them in real-time

- Filing claims on the spot

- Receiving a repair estimate

- Uploading images, videos, locations, and relevant data

- Quickly accessing documents

- Getting instant information about repair services

Travel Insurance

Travel insurance apps allow travelers to purchase and manage travel insurance policies, file claims, and access emergency assistance services while on the go. Benefits include:

- Covering unexpected medical expenses

- Accident & sickness medical expense reimbursement

- Guarding policyholders against luggage loss and trip cancellations

- Protecting the insured person in case of lost travel documents

- Making instant help accessible across borders

Business Insurance

Business insurance mobile apps help entrepreneurs and companies manage various types of commercial coverage, such as liability, property, and workers’ compensation. Features include:

- Selecting a suitable package based on business size & nature of risk

- Easily purchasing a policy

- Minimizing losses by quickly settling an insured event

Property Insurance

Property insurance mobile applications cover a broad range of property types, including homes, jewelry, real estate, artwork, and expensive equipment. Features include:

- Choosing a policy

- Filing claims

- Receiving property maintenance reminders

- Tracking a property for damages, breakdowns, leaks, and more

How Much Does It Cost to Develop an Insurance App?

The cost of developing an insurance app varies as per app complexity, company you hire, development time, third-party integrations, and app platform (iOS/Android). Even though there are several factors that affect the cost of insurance app creation, you can cut down costs by:

- Focus on must-have features first and avoid unnecessary add-ons that inflate development time and costs.

- Choose an app development company that offers high-quality service at a reasonable price.

- Build a basic version with essential features first and add advanced ones later based on user feedback.

- Instead of separate apps for iOS and Android, use frameworks like Flutter or React Native to develop both at once. How much does it cost to make a phone app? Get a breakdown of expenses from design to deployment.

- Hiring developers from cost-effective regions can significantly reduce expenses while maintaining quality.

- Insurance app development cost estimation depends on features, complexity, and platform.

- Use third-party APIs and ready-made tools for payments, authentication, and analytics instead of building everything from scratch.

The approximate cost will be:

- Basic App: $20,000 - $40,000

- Mid-Level App: $40,000 - $80,000

- Advanced App with AI & Blockchain: $80,000 - $150,000

Development Process of an Insurance Mobile App

The development process of insurance apps has various steps. When you follow each step with the right approach, you can get the best Mobile app for insurance businesses. Top insurance app development companies following a standardized process. Fulminous Software is a leading Mobile App Development Company specializing in the seamless development process of insurance mobile apps. Here we will discuss that.

.webp.webp)

Step 1: Market Research & Planning

An expert team of insurance app developers can help in this stage. Here we study competitors, customer needs, and industry trends to ensure your app stands out and meets market demands effectively.

Step 2: UI/UX Design

You need top-notch app designers at this stage. Focus on creating a clean, easy-to-use interface that makes navigation simple and enhances the overall user experience.

Step 3: Choosing the Right Technology Stack

Advice from skilled app developers and the project management team is essential at this stage. Pick the best programming languages, frameworks, and third-party tools to ensure smooth performance, security, and scalability.

Step 4: Development & Integration

Top-notch insurance app developers can do this task for you. Here they build the app’s core features, and integrate APIs, payment gateways, and databases, ensuring all functions work seamlessly together.

Step 5: Testing & Quality Assurance

When you choose an app development company for insurance software applications, you need to check whether they have a top-quality assurance team. Here they test to catch and fix any bugs or glitches before launching the app for users.

Step 6: Deployment & Maintenance

The deployment and post-launch support are the final stages of the insurance mobile app development process. Here we publish the app on the App Store and Google Play, then provide updates, fix issues, and ensure smooth operation over time.

Conclusion

Insurance organizations are shifting their services to mobile applications as per the demand of customers. The benefits of mobile apps are plenty for insurance agencies. When you build an app for an insurance company, everyone (users, admin, agents,) can do their tasks on a single platform. The integration of features to the insurance agency app also needs careful consideration.

If you want to build a mobile app for your insurance organization, we can help you. Fulminous Software offers the best insurance app development services. Our app development team follows the above-mentioned standardized process to develop the app.

As we have an expert team with deep knowledge of the insurance industry, you can become a leader in the industry with a trending app. We also build insurance web applications. To know more. Contact us!

Are you excited about the information discussed about the insurance mobile app development? Share your thoughts in the comments below! If you found this article useful, don’t forget to share it on your social media accounts.

Frequently Asked Questions About Insurance Mobile App Development

- Q1: What must-have features should an insurance app include?

- Features must be added by considering three types of users including admin, customers, and agents. The common features are:

- Easy policy management

- Quick claims processing

- Secure payments

- AI-powered suggestions

- Live chat support

- Instant alerts

- Q2: How much does it cost to develop an insurance app?

- Costs vary depending on several things! A basic app may cost $20,000-$40,000, while a high-end app with AI and blockchain could go up to $150,000.

- Q3: How do I pick the right app development company?

- Go for a team that knows the insurance industry, knows their security stuff, and makes apps that are easy to use and grow with you.

- Q4: Can I build one app for both iOS and Android?

- Yep! With Flutter or React Native, you can make one app that runs on both, so you save time and cash.

HIRE A TOP SOFTWARE DEVELOPMENT COMPANY

Verified

Expert in Software & Web App Engineering

Verified

Expert in Software & Web App Engineering

I am Manish Kumawat, co-founder of Fulminous Software, a top leading customized software design and development company with a global presence in the USA, Australia, UK, and Europe. Over the last 10+ years, I am designing and developing web applications, e-commerce online stores, and software solutions custom tailored according to business industries needs. Being an experienced entrepreneur and research professional my main vision is to enlighten business owners, and worldwide audiences to provide in-depth IT sector knowledge with latest IT trends to grow businesses online.

Partner with Top-Notch Web Application Development Company!

Discuss your Custom Application Requirements on info@fulminoussoftware.com or call us on +1-903 488 7170.

15 Days Risk-Free Trial