AI in Banking: Boost Efficiency, Personalization & Security with Agentic AI

Manish Kumawat

Last Updated on: 29 September 2025

You know the sensitivity of the banking industry, where each second counts and even a single digit can change things upside down. That's why banking institutions and businesses were in search of an ideal technology or tool that helps them with accuracy, quickness, automation, and security. The emergence of AI in the banking sector has fulfilled all their demands, and now all banking businesses are using AI in various tasks.

Even though the majority of banking businesses are using artificial intelligence to an extent, there are still many advantages to explore. At the same time, the innovations in Banking AI are upgrading day by day. Custom AI in banking is the only way to explore AI in banking to its maximum benefits.

Here we are going to see the complete aspects of AI in banking, including benefits, uses, implementation, costs, and ways to grab the maximum benefits of this amazing technology. Beyond some general information, this single guide can help you use AI in banking and implement it successfully.

Why Banking Businesses Need AI

The major reasons for banking businesses stepping back to implement AI in banking are the lack of awareness, Misconceptions, Resistance to change, and Budget constraints. But the reality is that implementing AI in banking is a must for banking businesses to survive in the tough competition in the market. Those who have not started using AI in banking are still facing challenges like:

Are you facing rising fraud risks?

As fraud issues come in various levels, your traditional tools are not enough to overcome this. AI for fraud detection in banking is the best way to stop fraud before it causes huge damage.

Are you struggling with complex compliance demands?

When the banking industry demands numerous complex compliances, it's not wise to follow manual KYC, AML, and regulatory reporting. AI implementation in banking helps you to follow all the regulations and compliance, even through automation.

Are you worried about inaccurate credit risk assessments?

Old models of credit risk assessments can be inaccurate due to poor insights. AI in risk management in banks can bring you accurate credit risk assessments through deep insights about each customer.

Are you unable to personalize services for every customer?

As there are plenty of banking institutions, the customers demand more personalized service, and if they don't get it, the chance to switch banking partners is high. AI solutions in banking are the best solutions for these important challenges.

Are you finding it expensive to provide 24/7 customer support?

In this digital banking era, customers may ask for support at any time. To set up a customer support team that works 24/7 is a tough and costly task. An AI chatbot in banking is the best way to provide full-time customer support, even more efficient with human-like service.

Are you struggling to manage massive volumes of data?

The time of numerous ledgers, documents, logs, and Excel sheets is gone. If you are still using these traditional tools, your employees may feel a burden that affects their productivity. AI agents in banking and agentic AI applications in banking can store, manage, evaluate, and give insights for the massive volume of data.

Are you concerned about staying competitive with fintechs and neobanks?

The rise of Fintech businesses and neo banks is raising the competition in the banking industry. The fact is that these institutions are already using AI in their tasks. So your banking business must adapt AI in banking, including generative AI fraud detection in banking and agentic AI in banking, which helps you to stay on top.

AI in Banking Market Trends

The banking sector has boosted growth with the adoption of artificial intelligence. This year, nearly 75% of global banks with assets exceeding $100 billion are expected to fully integrate AI in their operations.

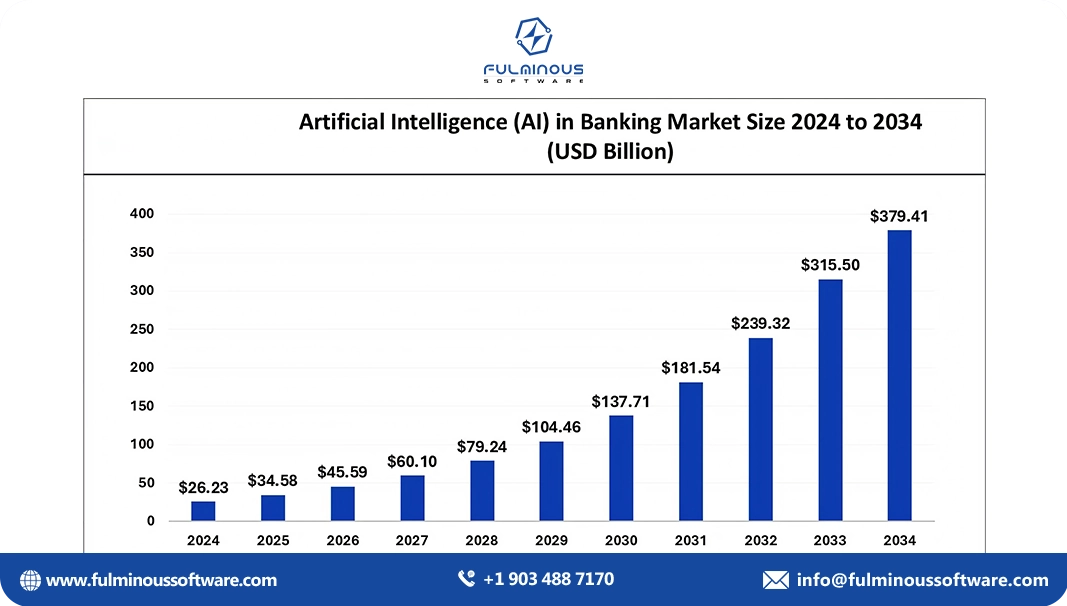

It's not only the story of banking business giants. Even small banks and financial businesses are considering AI in banking as their first priority. The trends show that revenue in AI in the banking market is about to reach USD 379.41 billion by 2034. Key market trends of AI in banking include:

| Trend | Description |

|---|---|

| Self-learning AI agents |

|

| Generative AI for compliance |

|

| Conversational AI chatbots |

|

| AI in cybersecurity |

|

| Hyper-personalization |

|

| Predictive analytics in lending |

|

| AI-driven wealth management |

|

Seeing this massive Market of AI in banking, your banking business needs to think wisely and make use of all the advanced features of AI in banking.

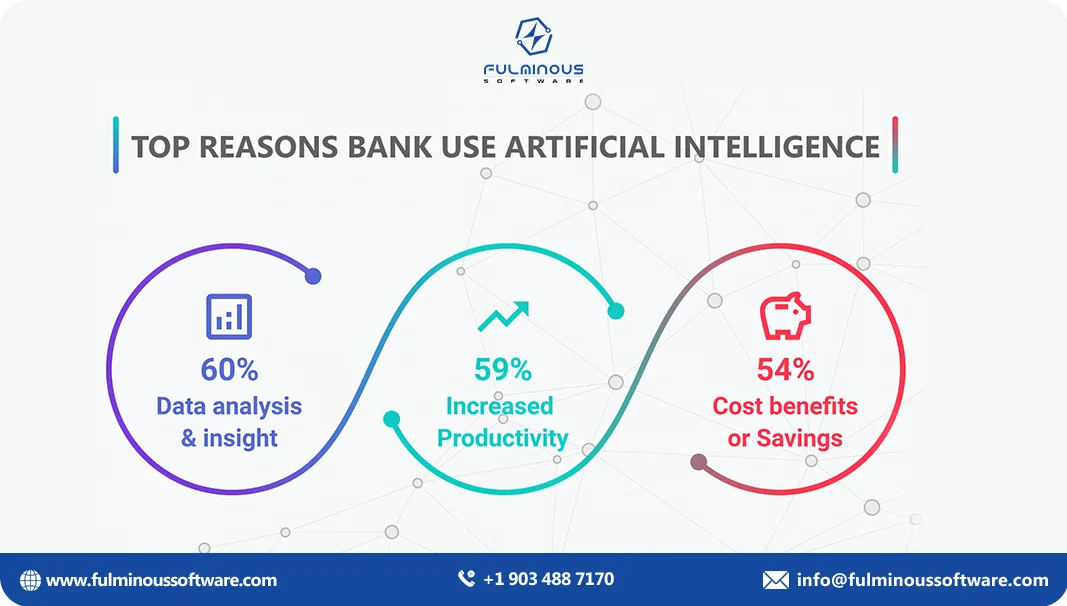

Advantages of AI in Banking

Even though there are many tools and technologies that help banking businesses, AI in banking brings more benefits compared to others. When we consider the benefits of AI in banking, it's far beyond our imagination, including:

- Process efficiency: Make your service and operations fast with no errors.

- Revenue growth: Personalized service is the ideal way to increase cross-selling by 20–30%.

- Customer loyalty: Up to 76% of consumers prefer banks that offer AI-driven personalization.

- Competitive edge: AI automation in the banking market keeps your business ahead of others.

- Enhanced fraud detection – Minimize financial crime and secure billions of your business using AI in banking.

- Better risk management – Get accurate credit scoring and predictive analytics for better risk management.

- Cost reduction – Automating manual tasks using AI and saving huge amounts.

- Regulatory compliance support – AI ensures reporting, audit trails, and documentation are easy and fast.

These are only a few of the countless benefits of AI in banking. When AI in banking offers this many benefits, you need to consider implementing AI in your banking services as soon as possible. A top AI development company for banking businesses can do these AI implementation tasks for your banking business.

AI in Banking Use Cases

The major highlight of AI in banking compared to other technologies is its applications in each task of banking. Yes, the use of AI in banking is not limited to a few operations. Even, it helps you in onboarding customers to top-level fraud detection tasks.

Fraud Detection & Prevention

You can see the number of fraud cases raised in the banking sector, which makes customers think twice before handing over their valuable assets to a bank. AI can guard your bank from fraud issues by watching every payment. If something looks strange, it stops it right away. These fraud detection and prevention features of AI in banking increase the credibility and trust of your bank.

Risk Scoring & Credit Assessment

In a scenario where plenty of loan applications come to you, in which some fake applicants approach you, you need a tool to find those who can pay back loans. AI can learn the saving and spending patterns of each customer and calculate their credit scores. This helps banks decide who is safe to lend money to. So your money will be in the safe hands of trustworthy customers.

Regulatory Compliance & Reporting

Banks have to follow too many regulations and comply to stay legal in the market. In traditional methods, you need a specialised team of experts to meet all these rules, which can be costly. AI in banking helps you to stay in alignment with all these regulations and compliance, even with timely updates. This keeps your banking business safe always.

Robo-Advisory & Wealth Management

In the bank, you have noticed some employees are sitting in a cabin where “May I help you?” is written. They are dedicated to meeting the needs of customers in person and helping them with custom services. But in a crowded situation, you can't meet each of them. That's why robo advisory and wealth management features of AI help banks to serve customers with personalised services, just like a smart friend.

Conversational Chatbots & Virtual Assistants

You can implement AI-powered chatbots and virtual assistants to help customers with each service 24/7. Both chatbots and virtual assistants possess human-like capabilities to chat with customers and help them in each step. Now, most of the leading banks have such chatbots and virtual assistants that save money and effort in customer service.

Hyper-Personalized Marketing

Marketing banking products, such as credit cards, loans, or deals, is a major part of banking business growth. But today, customers ignore some random ads in their busy schedule. That's why you need personalised marketing strategies that help you to reach each customer with the exact products or services they need, which increases the conversion rate. So get AI-powered marketing features to take marketing campaigns to 100% success.

Loan & Mortgage Automation

In old methods, both the bank and the customer spend too much time on loan applications and approval. When AI in banking enters, the scenario changes. AI automates the loan and mortgage tasks so that effort and time can be saved. The intervention of AI in such tasks brings accuracy, which keeps your banking business on the safer side.

AI in Cybersecurity

If you are worried about cyber attacks that may cause loss of millions within seconds, don't worry. AI brings advanced safety for your systems so that no cyber attackers or hackers can break your safety walls. When customers get to know the safety in your banking services, the trust increases, and your business grows.

AI Implementation in Banking: From Vision to Reality

After learning all these benefits and use cases of AI in banking, you may now think about the way to implement AI in banking. Remember, you need assistance from a leading AI development company like Fulminous Software to implement AI in banking smoothly. The AI implementation in the banking process has 6 major steps

Major Steps:

Step 1 - Define Objectives & Use Cases: In the initial step, you spend time with our AI development consultancy experts, and they note the objectives and possible use cases of AI in your banking business.

Step 2 - Prepare Data & Infrastructure: Once the plan is ready, our top AI development experts with banking sector experience prepare data and infrastructure for adding AI in banking.

Step 3 - Develop a Proof of Concept (PoC): With a clear focus on delivering cost-effective and growth-oriented AI solutions for your banking institution, Fulminous Software sets a PoC.

Step 4 - Integrate with Core Banking System: Then comes the integration stage, where top AI developers of Fulminous Software add trending solutions to your current banking systems.

Step 5 - Ensure Security & Compliance: Before complete deployment, the top AI team of Fulminous Software assesses the security and compliance of newly added AI features in banking.

Step 6 - Deploy, Monitor & Scale: Finally, Fulminous Software rolls it live, and now both customers and employees can access the newly added AI solutions. We also offer continuous monitoring and scaling.

For example, JP Morgan’s COIN platform automated legal work equivalent to 360,000 hours annually. The results prove that AI agents in banking are increasing both productivity and cost efficiency.

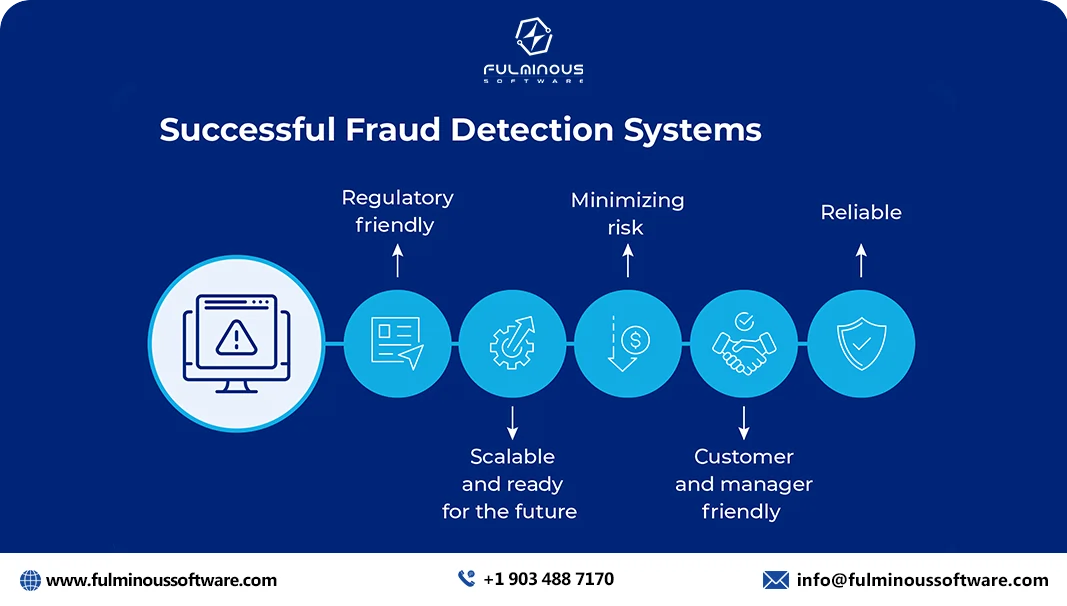

Fraud Detection: Strengthening Security with AI

In Europe alone, 43% of fraud attempts took place last year in the banking sector. But banks with AI solutions have eliminated those attempts before they cause damage. Fraud detection is one of the major use cases of AI in banking. AI for fraud detection in banking keeps your bank safe and improves trust among customers.

Banks like Barclays are using AI, and it's the backbone of their credibility in the banking industry. Remember that the traditional systems are always prone to fraud attempts. You can use generative AI fraud detection in banking and even deal with new fraud patterns daily. Fulminous Software is proficient in adding AI for fraud detection in banking.

Risk Management: Smarter, Faster, More Accurate

You can notice an increasing number of non-repayment loans. You cannot evaluate customers from peripheral information. Whether it's lending, investments, or compliance, AI in risk management in banks is crucial. In old methods, evaluating customer behaviour and credit history was a difficult and long process.

With AI applications in the banking industry, institutions can easily get accurate reports in minutes. When you get assistance from leading AI development companies like Fulminous Software, they will add advanced AI-powered risk management solutions to your core systems.

Agentic AI Applications in Banking

Agentic AI in banking is all about automating various banking operations. Instead of getting experts for each task, you can use AI agents that work like human experts and serve your customers with advanced solutions. The use case and benefits of agentic AI in banking are:

| Use Case | Benefits |

|---|---|

| Loan application reviews |

|

| Fraud detection & prevention |

|

| Risk assessment & credit scoring |

|

| Personalized financial planning |

|

| Regulatory compliance monitoring |

|

| Customer interaction automation |

|

| Operational efficiency |

|

Fulminous Softwares is a leading AI agent development company. We are especially proficient in crafting AI agents for the banking sector. You can get customised banking AI agents at the best prices.

Chatbots in Banking

AI chatbots in banking help banks and financial institutions with customer care and decision-making. Especially when it comes to customer care, you need to address banking customers' concerns fast. No matter whether they ask at night or day. AI chatbots for banks will serve you like an expert in these tasks. The use cases and benefits of AI chatbots in banking are:

| Use Case | Benefits |

|---|---|

| 24/7 customer support |

|

| Automating customer queries & transactions |

|

| Customer onboarding |

|

| Advisory support & recommendations |

|

| Proactive alerts & reminders |

|

| Scalable customer engagement |

|

| Cost efficiency |

|

Fulminous Software is a leading AI chatbot development company for banks and financial institutions. Get our services to add feature-rich AI chatbots to your banking systems and serve customers whenever they need support.

Generative AI in Banking

Generative AI in banking is another major AI solution that helps banks in various tasks. Beyond crafting perfect documents, generative AI in banking has a major role in personalizing your services and service innovations. When you succeed in serving each customer in a personalised way, they stay with you. The use case and benefits of Generative AI in banking are:

| Use Case | Benefits |

|---|---|

| Personalized customer communication |

|

| Automated report generation |

|

| Fraud scenario simulation |

|

| Customized investment portfolios |

|

| Regulatory compliance documentation |

|

| Real-time insights for advisors |

|

| Synthetic data for risk modeling |

|

| Faster product innovation |

|

Fulminous Software is a leading generative AI development company for banks. Our top generative AI development expert has experience in serving various banks and financial institutions, which brings more industry-focused solutions.

Cost to Implement AI in Banking

Banking businesses with ambitions to use AI in their banking services must have a clear idea about AI implementation costs. When you approach each AI development company, they give you a different price list. But as a trusted AI development company that offers the most affordable AI solutions for banks, Fulminous Software can give you the best pricing list. Key Cost Factors for the implementation of AI in banking are:

- AI Use Case

- Data Infrastructure

- Integration Complexity

- Customization Level

- Team & Expertise

- Regulatory Compliance

- Maintenance & Updates

- Training Staff

- Licensing Fees

- Scalability Needs

- Support Services

Estimated Cost Breakdown

- AI Chatbot for Banking – $50,000 – $150,000

- Fraud Detection System – $200,000 – $500,000+

- Risk Scoring / Credit Assessment AI – $150,000 – $400,000

- Generative AI for Compliance & Reporting – $300,000 – $800,000

- Enterprise-Wide AI Implementation – $2 million – $5 million+

Ongoing Costs

- Cloud & Infrastructure – $10,000–$50,000/month

- AI Model Maintenance & Updates – 15–20% of initial project cost

Fulminous Software: Best Partner for AI in Banking

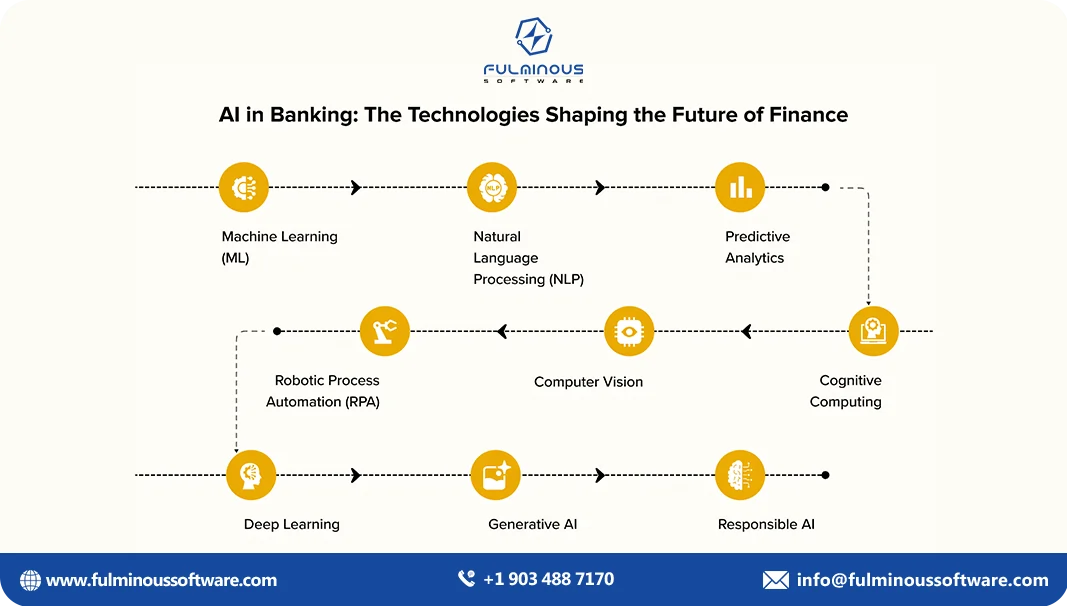

Fulminous Software is a leading AI development company for banks and financial institutions. Our AI development team is an expert in delivering customized solutions, including chatbots, AI agents, ML, NLP, generative AI, and many more.

As we have been serving banking and financial institutions with advanced AI solutions, you will get unique AI solutions that fit your banking business goals. Fulminous Software also offers a complete AI development package for banks, starting with consultation, development, and post-launch support.

Why Fulminous Software?

- Low-cost AI services for all banks

- Latest AI solutions for banks

- Best AI team

- Strong banking industry expertise

- Long-term support

- Safe banking AI solutions

- Custom AI built for the bank’s goals

- Simple AI fits with current systems

If you want the best AI solutions for banking, Fulminous Software is the only choice. Explore our AI development services now!

Conclusion

When AI has numerous roles in banking, including AI for fraud detection in banking, to AI in risk management in banks, banking institutions must consider AI implementation as their priority. Even agentic AI use cases in banking can greatly boost your banking operations. The demand for AI automation in the banking market is also growing beyond limits. In such a scenario, the one decision that takes your banking business to the peak of success is the implementation of AI.

So it's time to get assistance from a leading AI development company. Fulminous Software is a leading AI development company with expertise in crafting custom solutions for AI in banking. Contact us now! Share this article.

FAQs

Q1. What are the main use cases of AI in banking?

The top AI in banking use cases include:

- Fraud detection

- Credit scoring

- Regulatory compliance

- AI automation in banking market

- Chatbots

- Robo-advisory

- Loan automation

- Hyper-personalized services

Q2. How much does it cost to implement AI in banking?

The cost of AI application in banking industry ranges from $50,000 to $5 million+, and an AI chatbot in banking may cost $50K–$150K.

Q3. How is generative AI used in banking?

Generative AI trends in banking help in:

- Automate compliance reports

- Create personalized financial updates

- Stimulate fraud scenarios

- Improve decision-making

- Generative AI fraud detection in banking

Q4. What is agentic AI in banking?

Agentic AI applications in banking refer to the use of AI agent in banking tasks, including:

- Loan reviews

- Investment recommendation

- Routine banking tasks

- Compliance checks

- Fraud detection

Q5. Why choose Fulminous Software for AI in banking?

Fulminous Software is a leading AI development company that serves banks and financial institutions with AI adoption in banking. We offer:

- AI Agent Development for Banks

- AI Chatbot Development for Banks

- AI Implementation Consultancy for Banks

- Fraud Detection AI Development for Banks

- Risk Scoring & Credit AI Solutions for Banks

- Loan & Mortgage Automation AI for Banks

- Robo-Advisory Platform Development for Banks

- Generative AI Solutions for Banks

- Cybersecurity AI Development for Banks

- Insurance Claim Automation AI for Banks

Verified

Expert in Software & Web App Engineering

Verified

Expert in Software & Web App Engineering

I am Manish Kumawat, co-founder of Fulminous Software, a top leading customized software design and development company with a global presence in the USA, Australia, UK, and Europe. Over the last 10+ years, I am designing and developing web applications, e-commerce online stores, and software solutions custom tailored according to business industries needs. Being an experienced entrepreneur and research professional my main vision is to enlighten business owners, and worldwide audiences to provide in-depth IT sector knowledge with latest IT trends to grow businesses online.

Partner with Top-Notch Web Application Development Company!

Discuss your Custom Application Requirements on info@fulminoussoftware.com or call us on +1-903 488 7170.

15 Days Risk-Free Trial