NBFC Loan App

Quickloan

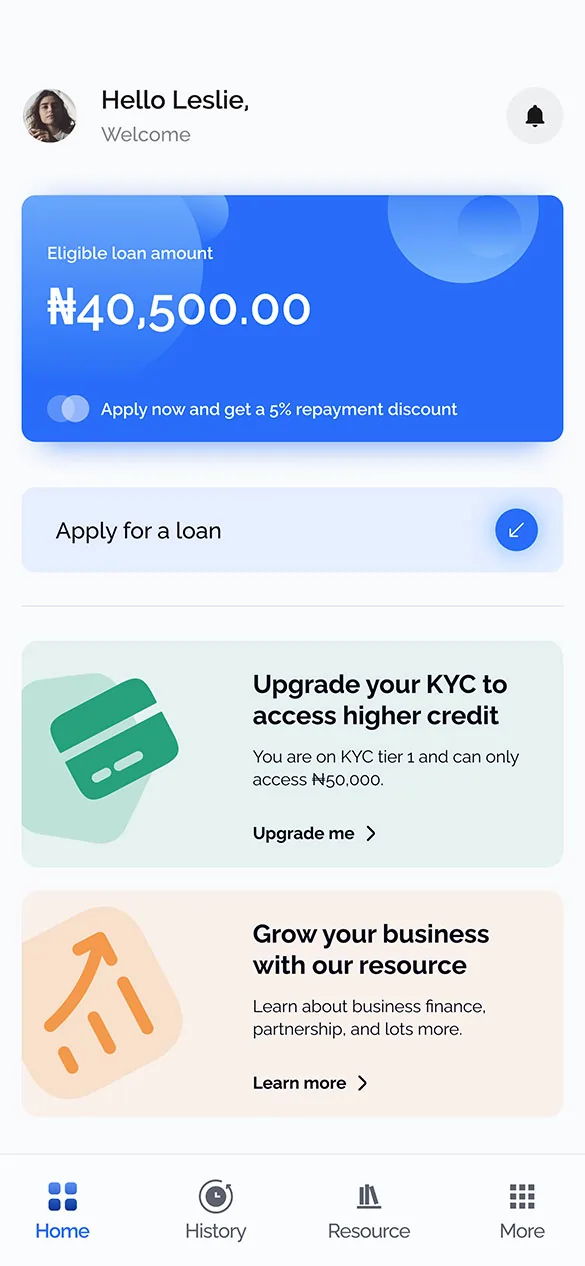

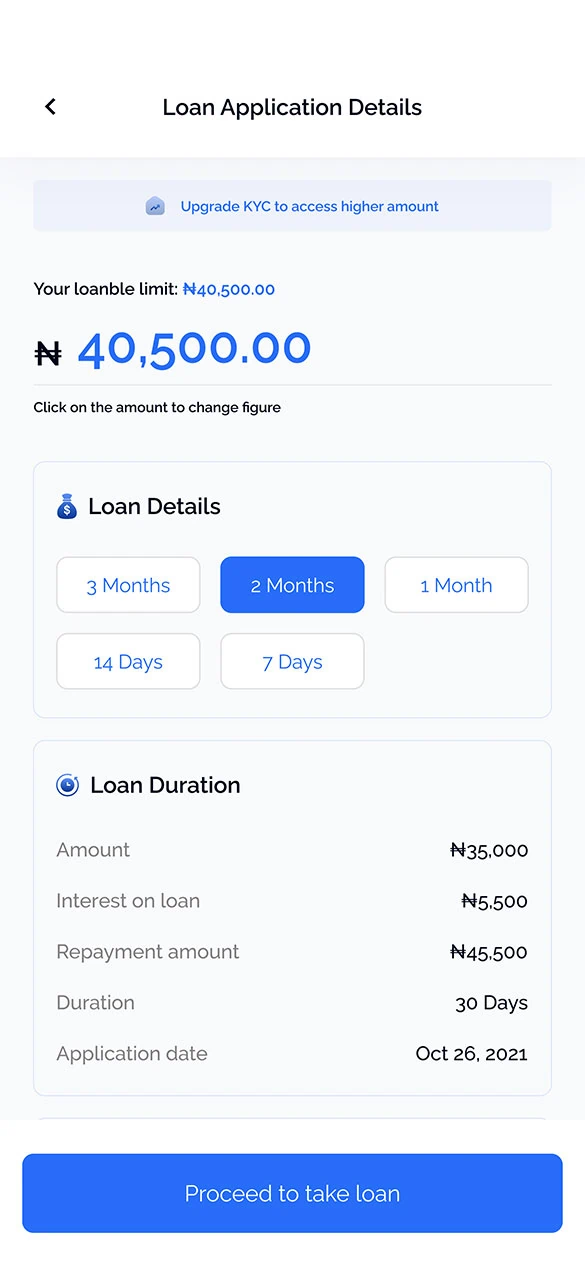

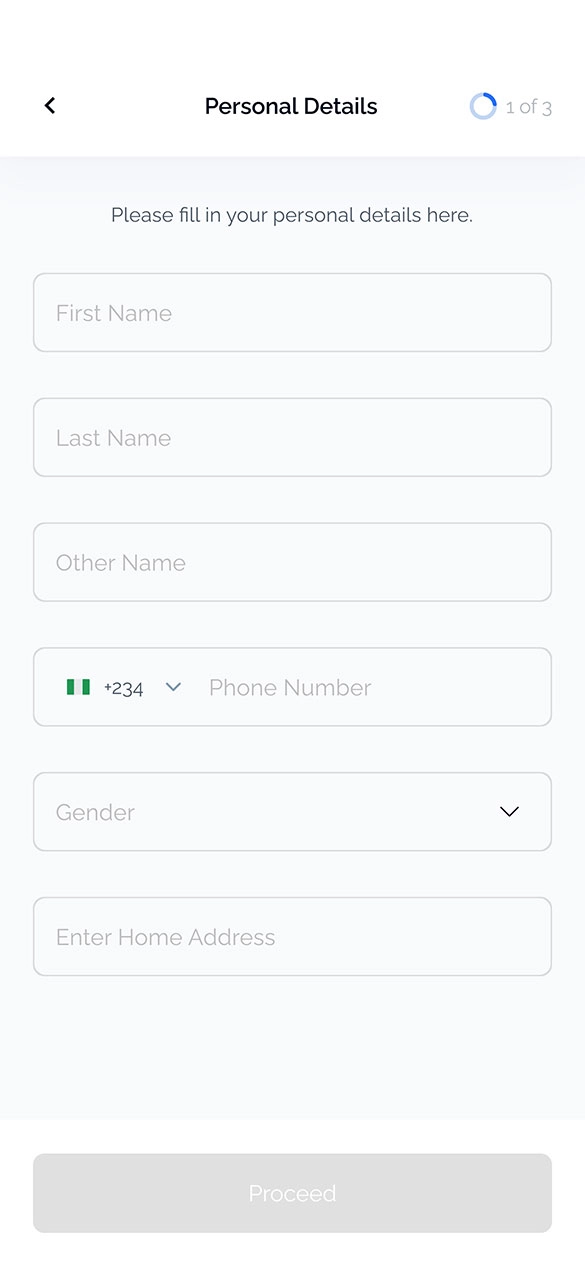

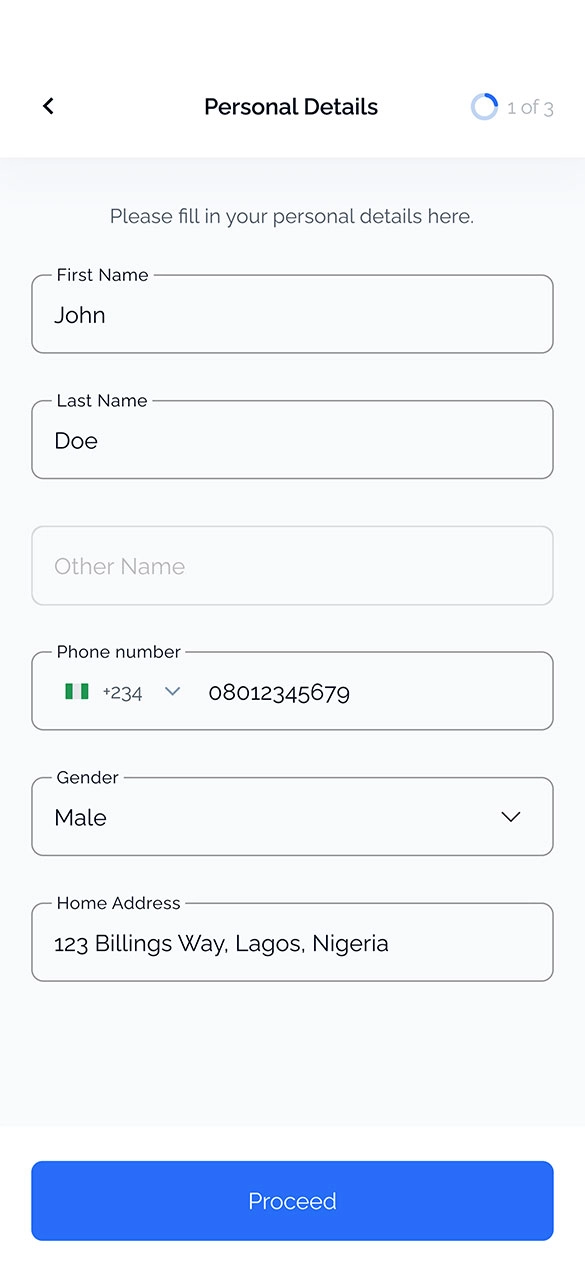

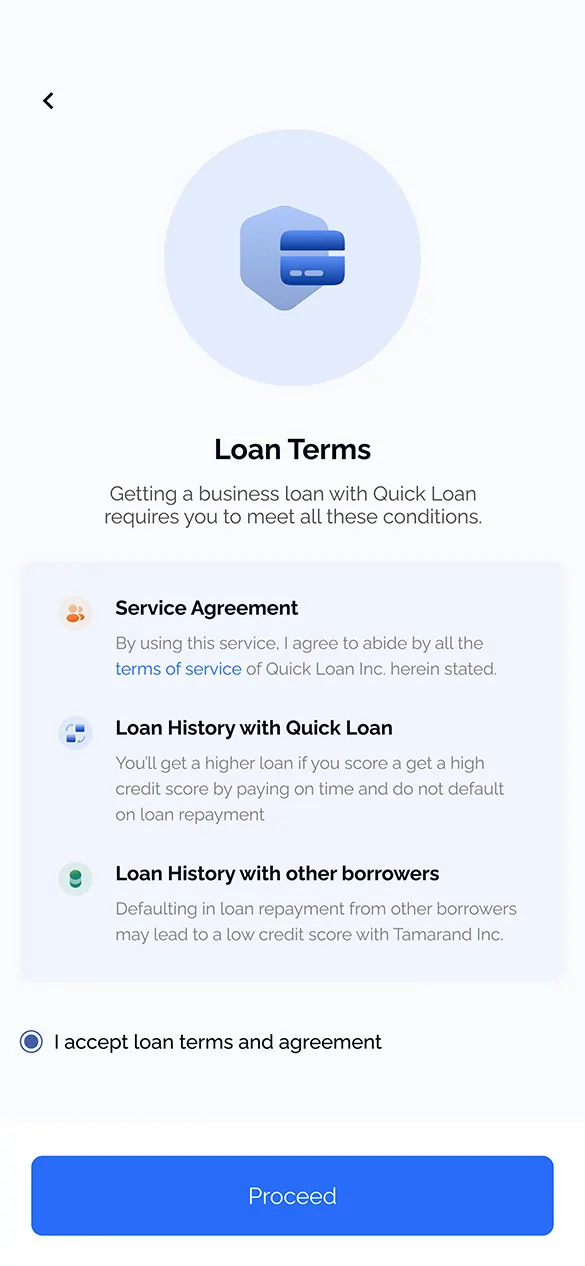

The Quickloan app is an outstanding NBFC loan application crafted by Fulminous Software. Quickloan is a top-choice loan app due to the experience of the Fulminous app development team, which continuously produces great returns for its stakeholders. As the result of the creative app development process and dedication of the app development team of Fulminous, this unique loan app has a smooth loan application process that excites users and offers several advantages for lenders, borrowers, and app administrators. Modern features like fast loan approvals, adjustable repayment plans, and strong security measures are integrated by the app development team of Fulminous Software in the Quickloan app.

A Profitable Loan App

Quickloan is a profitable NBFC loan app developed by the proficient app development team of Fulminous Software. Today, as a result of the Fulminous Software team’s brilliance in mobile app development, Quickloan is a leading NBFC loan app in the financial industry with a steadily growing user base.

Unique Features of Quickloan NBFC Loan App

- Instant Loan Approvals

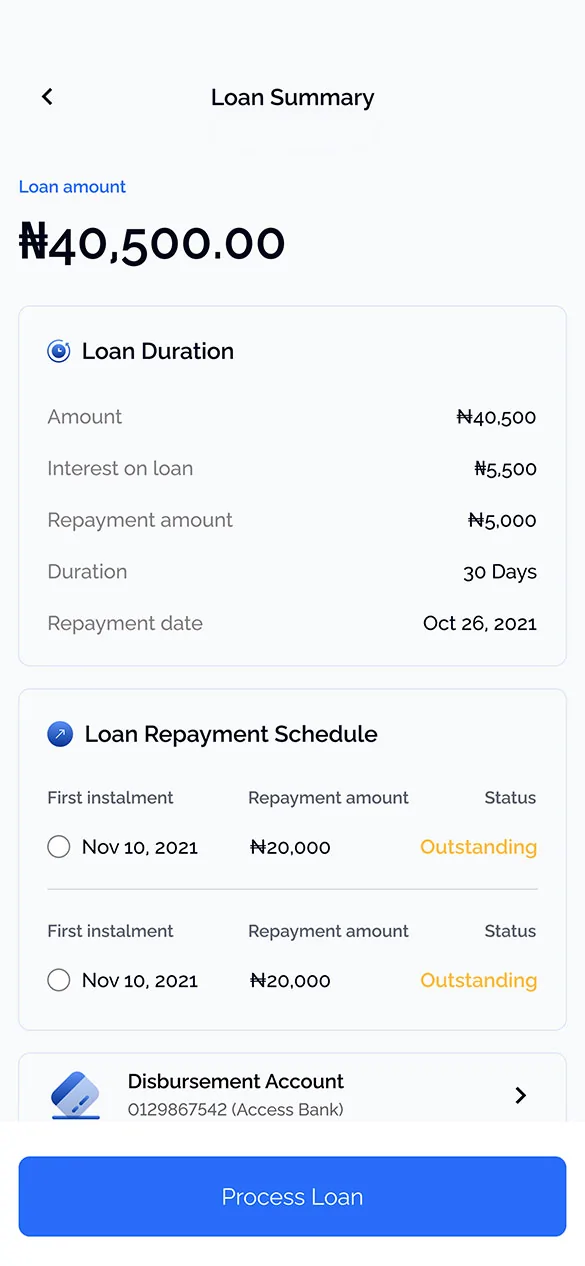

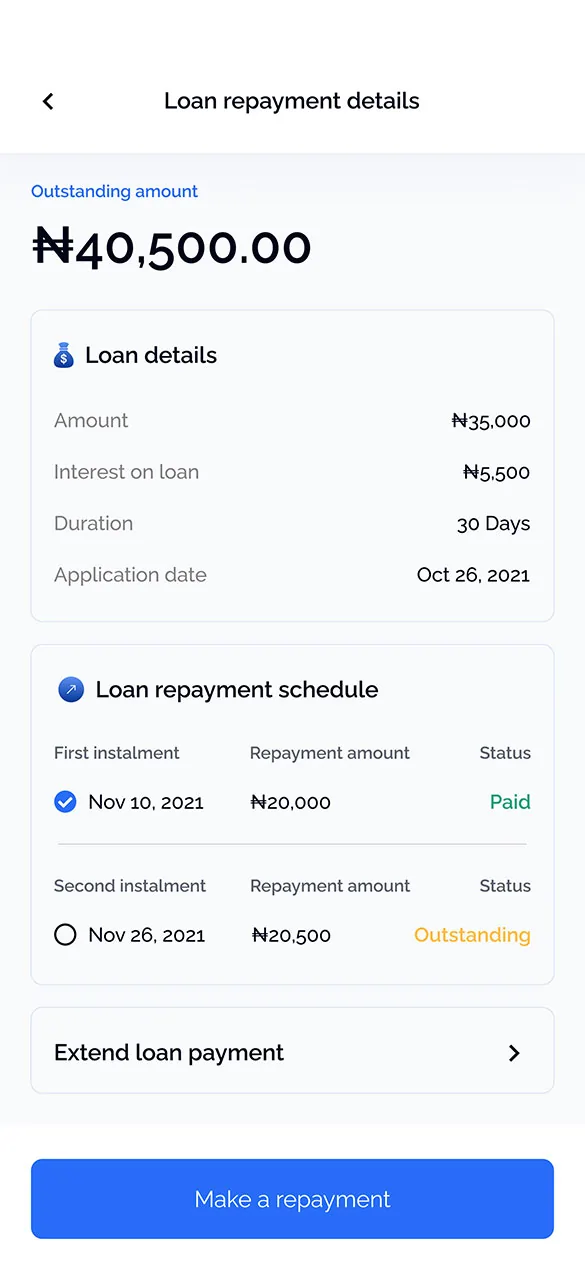

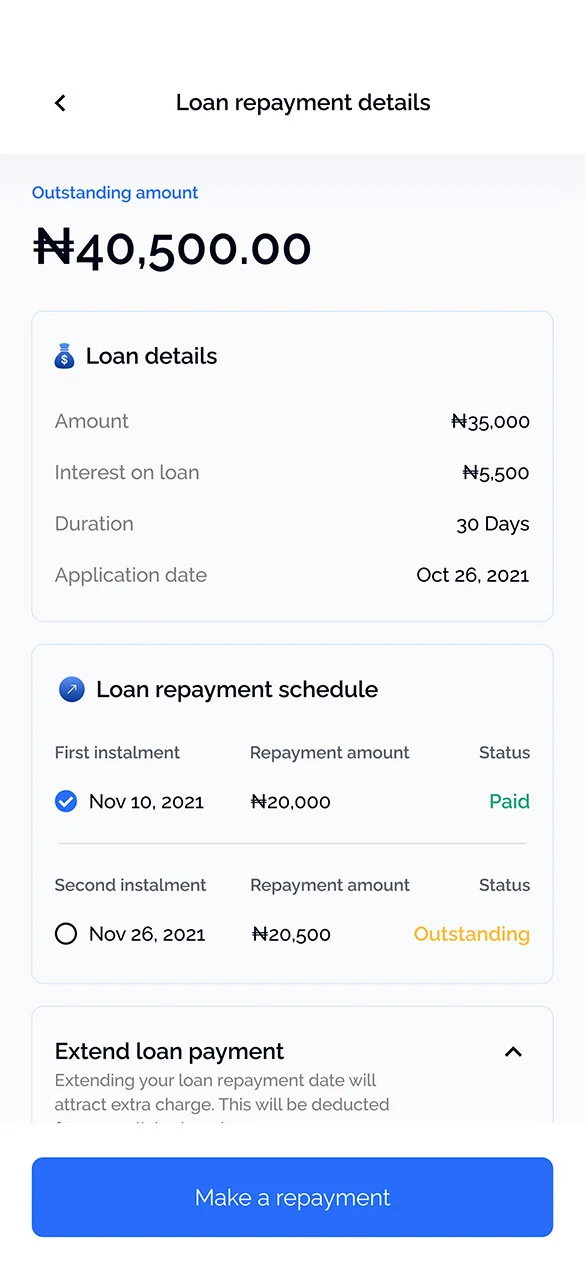

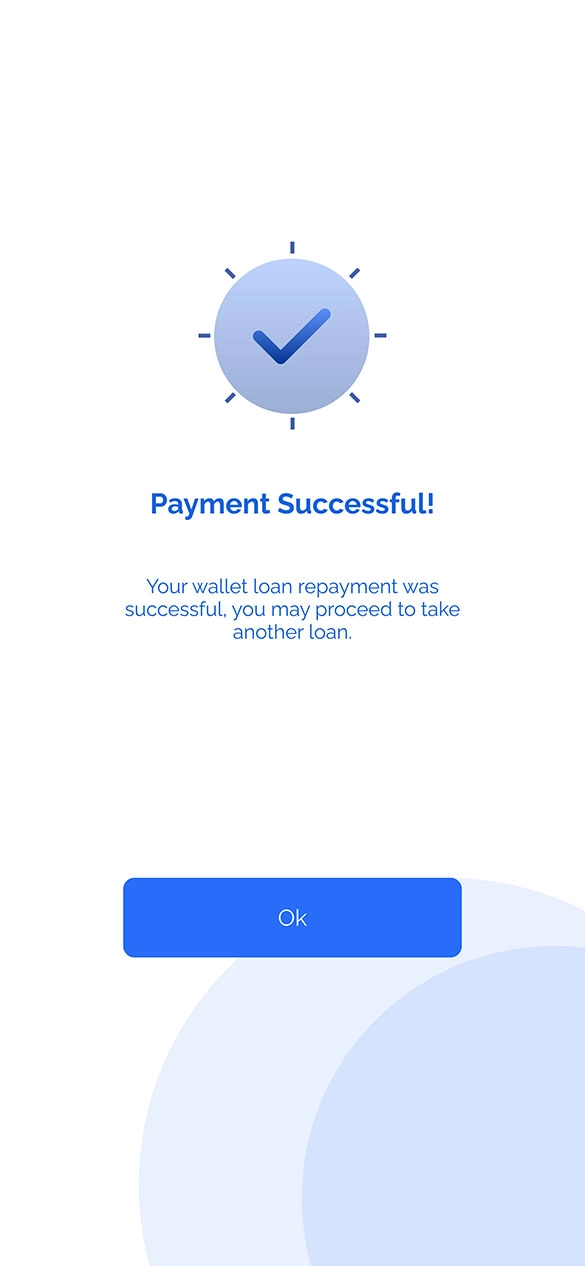

- Flexible Repayment Options

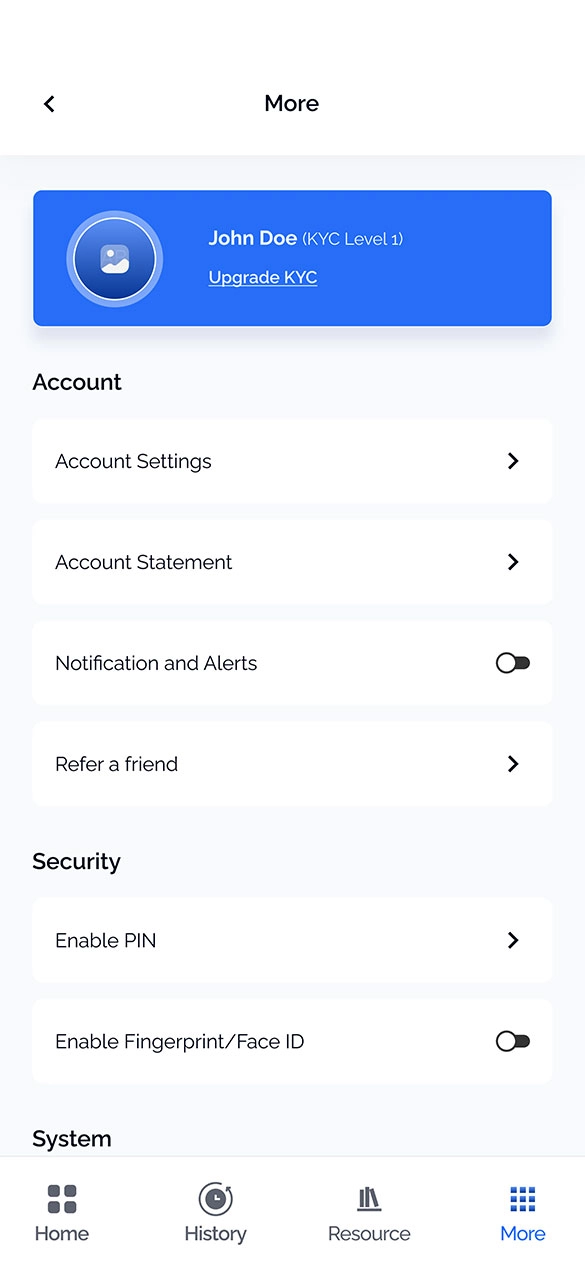

- Robust Security Measures

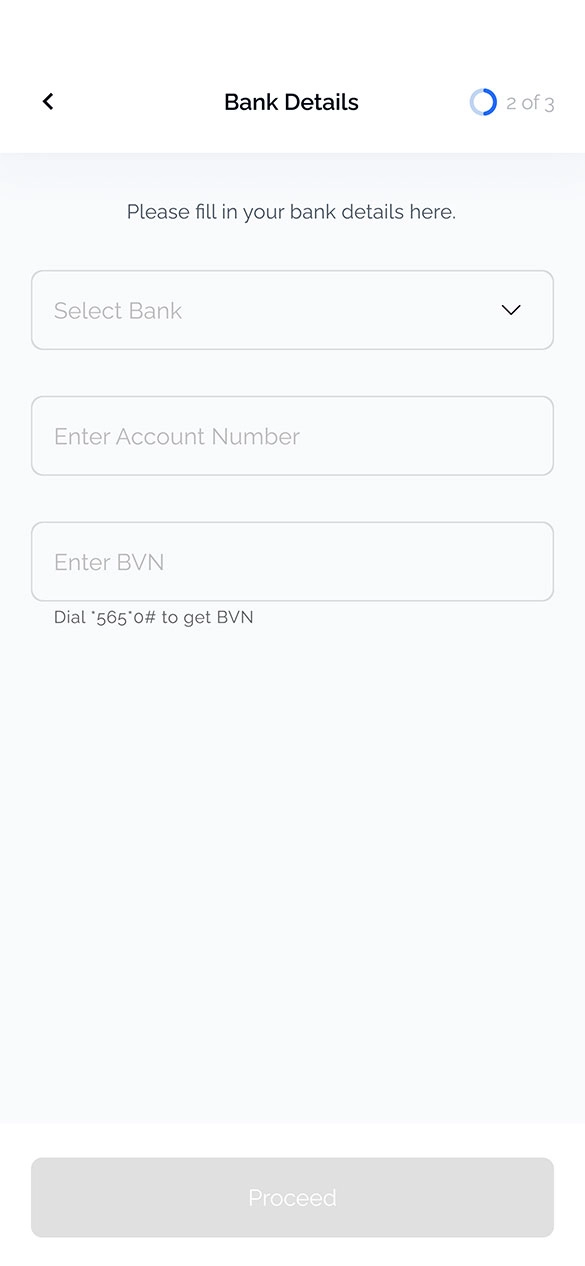

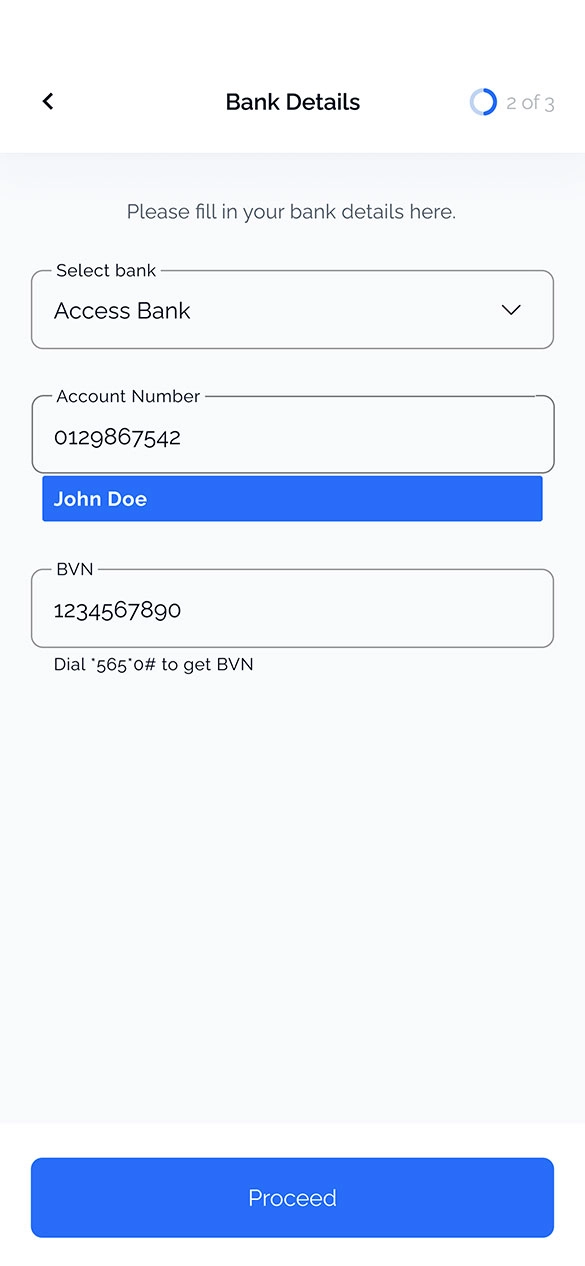

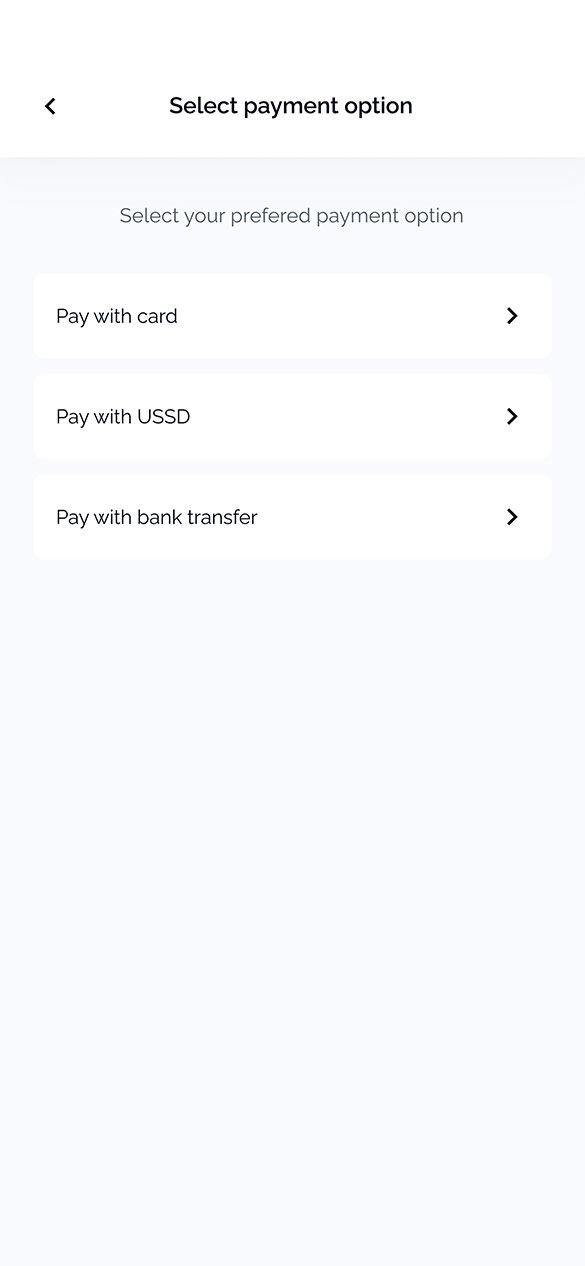

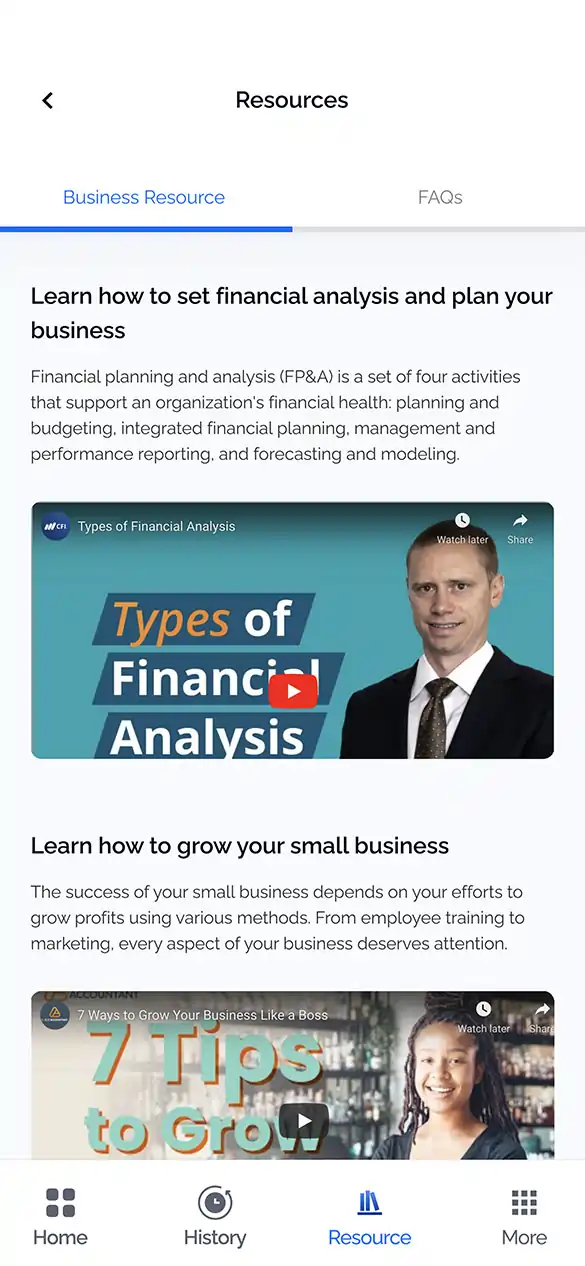

- User-Friendly Interface

- Real-Time Loan Tracking

- Personalized Loan Offers

- 24/7 Customer Support

- Paperless Documentation

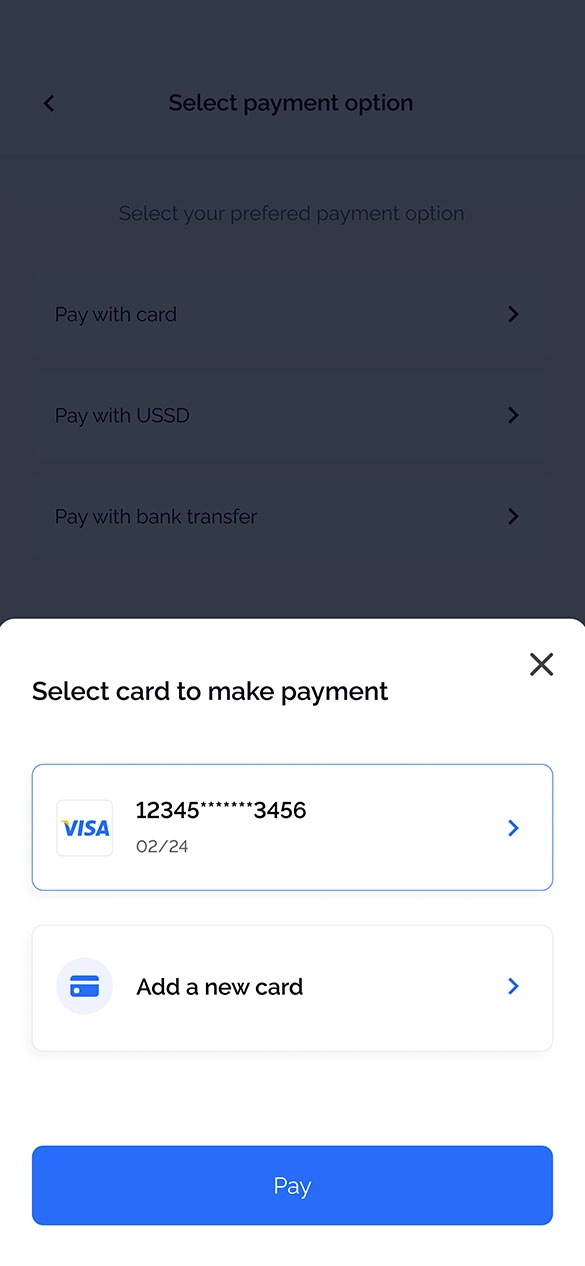

- Integrated Payment Systems

- Credit Score Monitoring

- Low-Interest Rates

- Quick Disbursement

- Loan Calculator

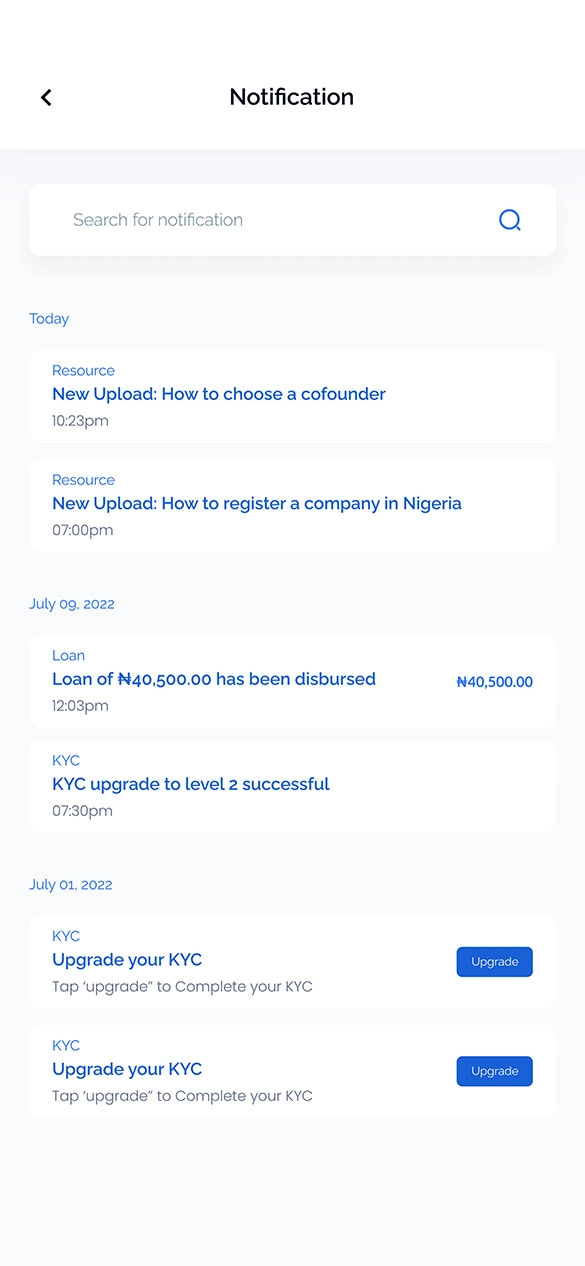

- In-App Notifications

- Auto Debit Facility

- Multi-Language Support

- EMI Reminders

- Detailed Loan History

Business Type

NBFC/Loan

Technology

- Mobile: Hybrid app with React Native

- Backend: AWS EC2, AWS S3, AWS Lambda, .NET Core, EF Core

- Database: MS-SQL Database

- Deployment: Dockers, Docker-Compose, Github CI/CD Pipeline

Challenges

As the financial industry evolves with cutting-edge innovations and there is a need for strong security measures, our team faces several challenges in developing the Quickloan NBFC loan application. Here are the primary obstacles we encountered.

01

Demand for Unique Features

Meeting the high demand for unique, user-friendly features that set Quickloan apart from competitors was a significant challenge. The reason for the difficulty was balancing innovation and practicality with financial regulations.

02

Complexity in Managing Regulatory Compliance and Integration with Financial Systems

Adhering to the ever-changing regulatory requirements while integrating with various financial systems was complex. Ensuring compliance with KYC (Know Your Customer), AML (Anti-Money Laundering), and other financial regulations added layers of difficulty.

03

Complexity in Integrating Paperless Documentation and Approval

Developing a seamless paperless documentation and approval process was challenging. Ensuring that digital signatures, document uploads, and automated approval workflows were secure and efficient required sophisticated technology.

04

Need for Strong Security Measures for Fraud Detection and Prevention

Implementing robust security measures to detect and prevent fraud was crucial. The most challenging task was to ensure that the app could protect sensitive financial and personal data from breaches and unauthorized access.

Solution

The Fulminous Software team leveraged these challenges as opportunities to demonstrate our expertise and innovation. The ability to overcome these obstacles is again proved by our team in this app development project. Here’s how we addressed each challenge.

01

Implemented Innovative Features

To meet the demand for unique features, our team focused on user-centric design and functionality. Deep market research and user feedback sessions are the two methods used by our team to identify and implement unique features.

02

Established Rigorous Compliance and Integration Protocols

Addressing the complexity of regulatory compliance and integration with financial systems, we established rigorous protocols. By implementing automated KYC and AML checks and seamlessly integrating with financial systems, the app development team of Fulminous ensured compliance.

03

Developed Secure Paperless Documentation and Approval Systems

To integrate paperless documentation and approval, we developed a secure and efficient digital workflow. Advanced encryption and digital signature technologies are used by the app development team of Fulminous for paperless documentation.

04

Implemented Advanced Security Measures

For fraud detection and prevention, our team employed cutting-edge security technologies. Multi-factor authentication, real-time fraud detection algorithms, and regular security audits to safeguard user data and prevent unauthorized access are implemented by our team.

The Results

The Quickloan app owners and stakeholders are extremely happy with the exceptional service from the app development team of Fulminous. The Quickloan NBFC loan app developed by Fulminous Software has a strong user base of more than 21,000 users. This growth in the number of users has resulted in significant profits for owners, with about 260% ROI. With over ₹75 lakh disbursed and partnerships with more than 6 lending partners, Quickloan has established itself as a leader in the financial industry. As the result of quality and affordable app development services from the Fulminous team, Quickloan owners have assigned the development of the iOS version of this app to our team.

Users

21000+

Lending partners

1400+

Amount disbursed

75 Lakh+

ROI

260%

Get in Touch with Us

Have questions, inquiries, or just want to say hello? Fill out the form below, and our team will get back to you promptly. We're here to assist you every step of the way.

Contact UsLatest Blogs And News

Our offshore IT consulting services along with the AI-powered core helps top companies stay competitive, win new markets and increase shareholder value.